Editor's Message: CPG Market Review Summer 2024

With already half of the year behind us, the rare coin market finds itself in a much healthier state that many would have guessed seven months ago.

At the shows I have attended thus far this year, I have observed a robust trade and relatively good attendance from both dealers and collectors. In speaking with dealers, many have been pleasantly surprised with their levels of business thus far. Certainly, there has been some cases in which there are more sellers than buyers, but the major rare coin dealerships and market makers have been steadily buying; in other words, the market has been able to maintain a healthy flow of material. On the auction front, we have continued to see strong prices paid for rarities and fresh price records set. Heritage alone, in just their Signature and Platinum Night U.S. coin sales have had more than $88.3 million in prices realized. Stack’s Bowers adds another more than $20 million, and there is much more if you add the totals of regular weekly auctions from the other major online auction firms.

The other major market story over these first six months is precious metals prices. The gold spot price basis of our last CPG® issue was $2,016. As I write this column on the Friday before Memorial Day, gold sits at $2,338, a 16% increase. During this time period, gold topped out at just under $2,450 on May 20, easily an all-time high. These huge swings have brought a significant amount of attention to the yellow metal, both from within the coin business and the wider investor industry. In nearly twenty years of tracking and reading about gold prices, I do not recall a time in which more articles about the gold price and the reasons for its surge have been written for financial websites, blogs, and social media posts. The most oft-cited reason for gold’s upward trajectory is due to what is perceived as persistent inflation, and the associated interest rate levels as set by the Federal Reserve. I personally do not think this tell the whole story, as much of the demand for physical gold has been coming from sovereign entities, specifically central banks and governments who wish to protect their reserves. This signals that more and more institutions and individuals are seeing gold as a monetary instrument and not just an investment vehicle. My reasoning is that often in the past, gold has spiked higher, only to quickly come back down to where it started or even below. With gold sustaining a nearly four-month rally, a shift may be occurring in which the gold spot price is less driven by speculative traders and more by those who view gold as alternate currency. Meanwhile, silver had been lagging gold in a major way, until March. Multiple price breakouts over the last 120 days have pushed silver to above $30 per ounce. While I was not surprised that silver easily held the $23 to $24 level, I did not think that it would reach the $30 mark so quickly. This is all great news to long term physical bullion investors, as their positions present many options. Collectors who own bullion that is strongly in a profit position can take some cash off the table or choose to roll some of that bullion into collector-investor grade vintage coins. To conclude, the elevated levels of precious metals have generated much activity within the rare coin industry, and this should persist through the rest of 2024.

Sincerely,

Patrick Ian Perez, patrick@greysheet.com

Download the Greysheet app for access to pricing, news, events and your subscriptions.

Subscribe Now.

Subscribe to RQ Red Book Quarterly for the industry's most respected pricing and to read more articles just like this.

Author: Patrick Ian Perez

Patrick Ian Perez began as a full time numismatist in June of 2008. For six years he owned and operated a retail brick and mortar coin shop in southern California. He joined the Coin Dealer Newsletter in August of 2014 and was promoted to Editor in June 2015. In the ensuing years with CDN, he became Vice President of Content & Development, managing the monthly periodical publications and data and pricing projects. With the acquisition of Whitman Brands, Patrick now serves as Chief Publishing Officer, helping our great team to produce hobby-leading resources.

In addition to United States coins, his numismatic interests include world paper money, world coins with an emphasis on Mexico and Germany, and numismatic literature. Patrick has been also published in the Journal of the International Bank Note Society (IBNS).

Related Stories (powered by Greysheet News)

View all news

With a handful of major coin conventions already come and gone, and with the first Whitman Baltimore Expo right around the corner, the rare coin market has proven very resilient in the face of corrections in other markets.

Gold and especially silver has continued to climb, with silver well above the $32 line as I write this column.

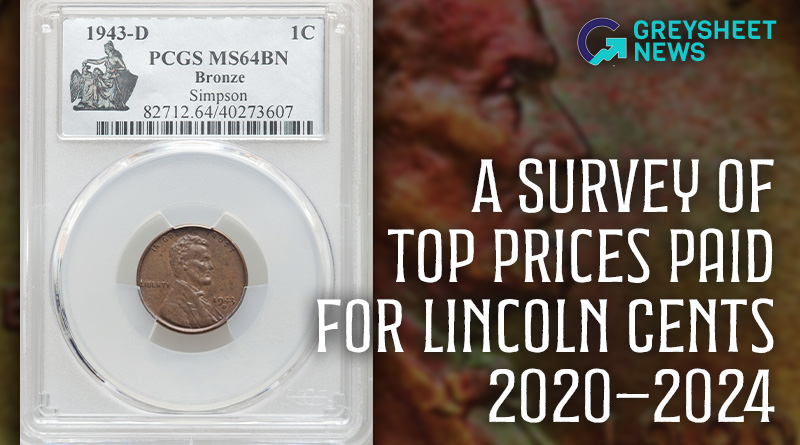

The beauty of the Lincoln Cent's 115-year (and counting) run is that it can be collected by every single level of coin collector.

Please sign in or register to leave a comment.

Your identity will be restricted to first name/last initial, or a user ID you create.

Comment

Comments